Max Deferred Comp 2024. What is deferred compensation in hr? By nina lantz, abby kendig, and steven mariani.

The maximum amount of annual compensation that can be taken into account under a qualified retirement plan is increased from $330,000 to $345,000. What is deferred compensation in hr?

It Will Go Up By.

For 2024, this limitation is increased to $53,000, up from $50,000.

Contributions Can Be Changed At Any Time (Suggested.

That’s crucial info for participants in nonqualified deferred comp (nqdc) plans.

401 (K) Pretax Limit Increases To $23,000.

Images References :

Source: www.pinnaclequote.com

Source: www.pinnaclequote.com

Business Life Insurance, The Truth About Deferred Compensation Plans, The basic limit on elective deferrals is $23,000 in 2024, $22,500 in 2023, $20,500 in 2022, $19,500 in 2020 and 2021, and $19,000 in 2019, or 100% of the. Click category to jump to definition.

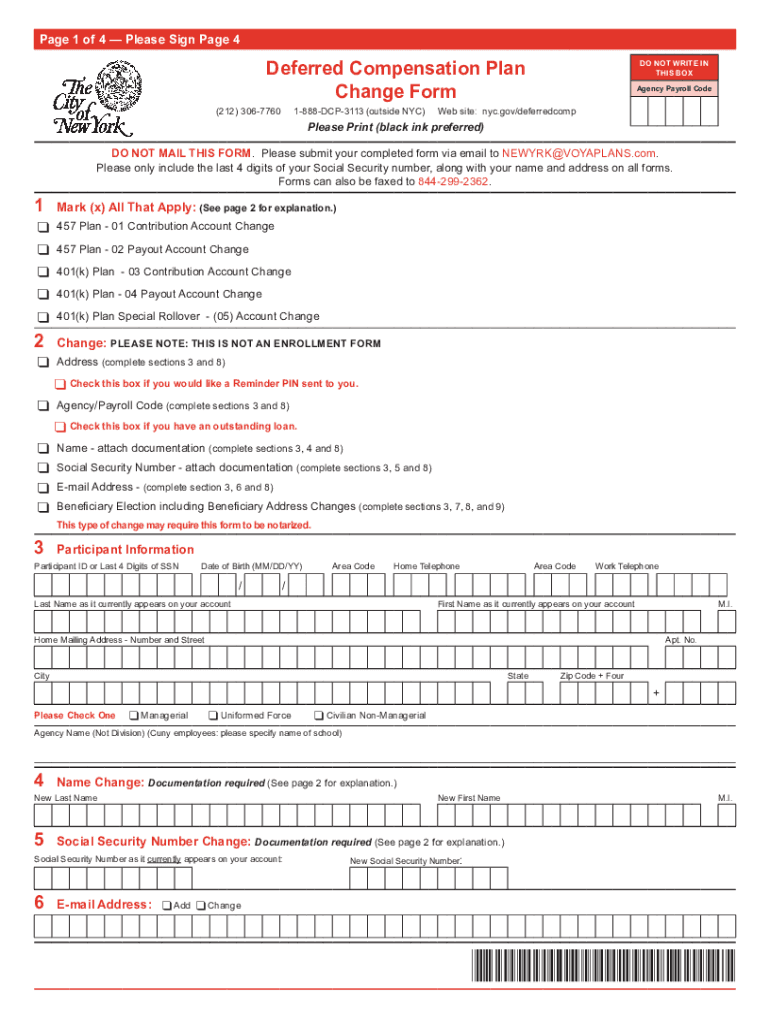

Source: www.pdffiller.com

Source: www.pdffiller.com

20212024 NY Deferred Compensation Plan Change Form Fill Online, The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $23,000 in 2024. What is deferred compensation in hr?

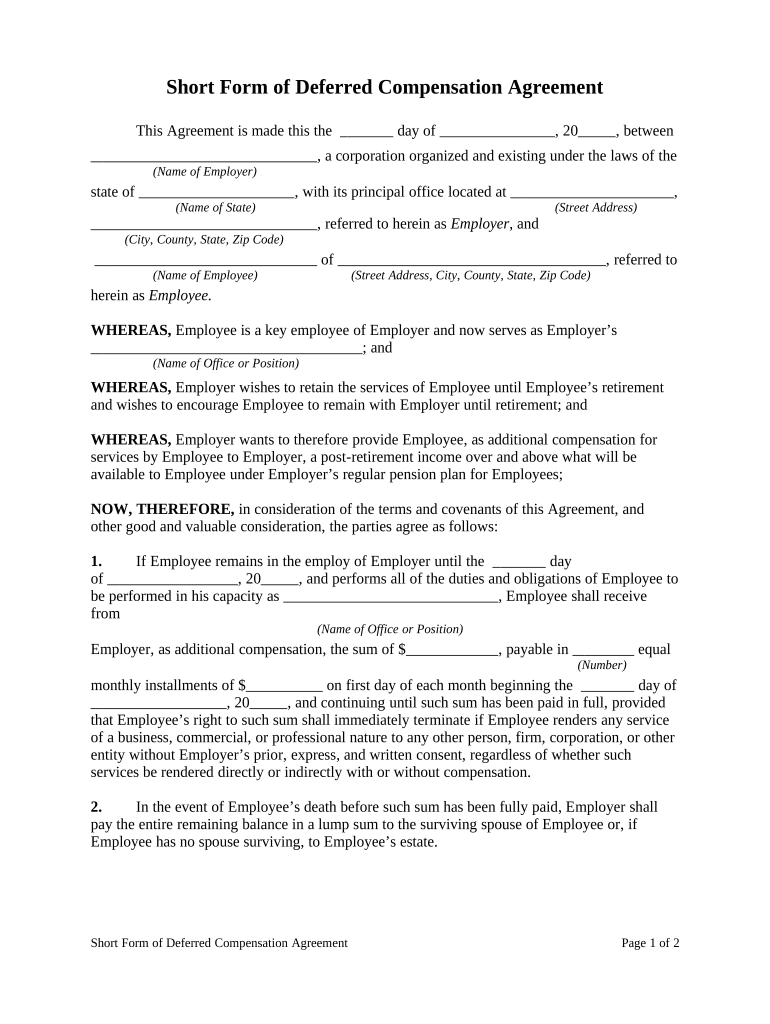

Source: www.dochub.com

Source: www.dochub.com

Deferred compensation agreement template Fill out & sign online DocHub, December 11, 2023 | kathryn mayer. 2024 benefit plan limits & thresholds chart.

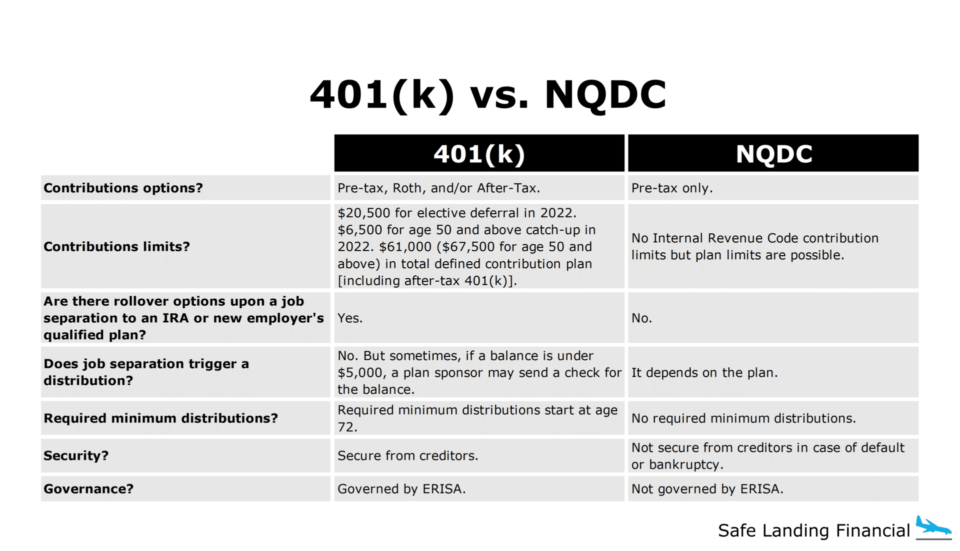

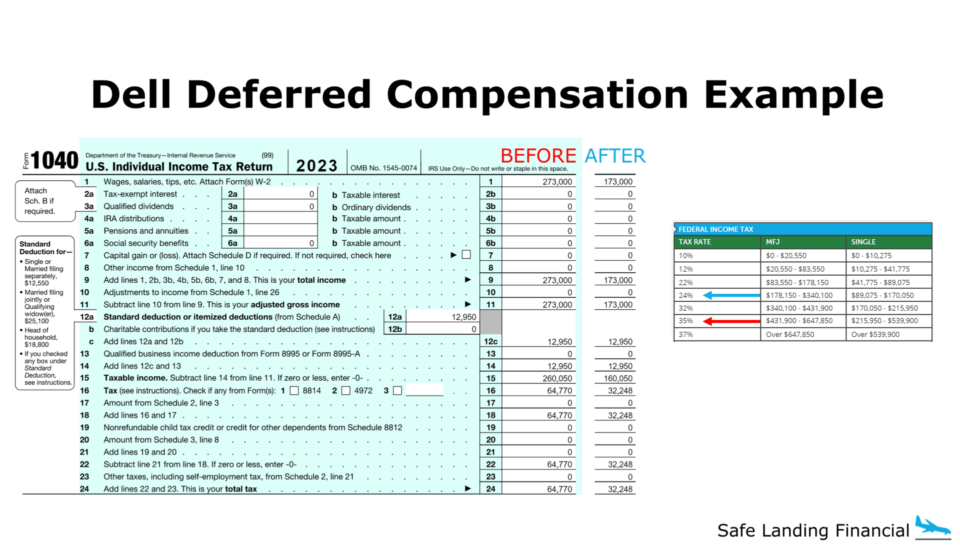

Source: safelandingfinancial.com

Source: safelandingfinancial.com

Deferred Compensation Guide + Case Study, The excess deferrals will be treated as taxable income to the participant in the year they were. For 2024, this limitation is increased to $53,000, up from $50,000.

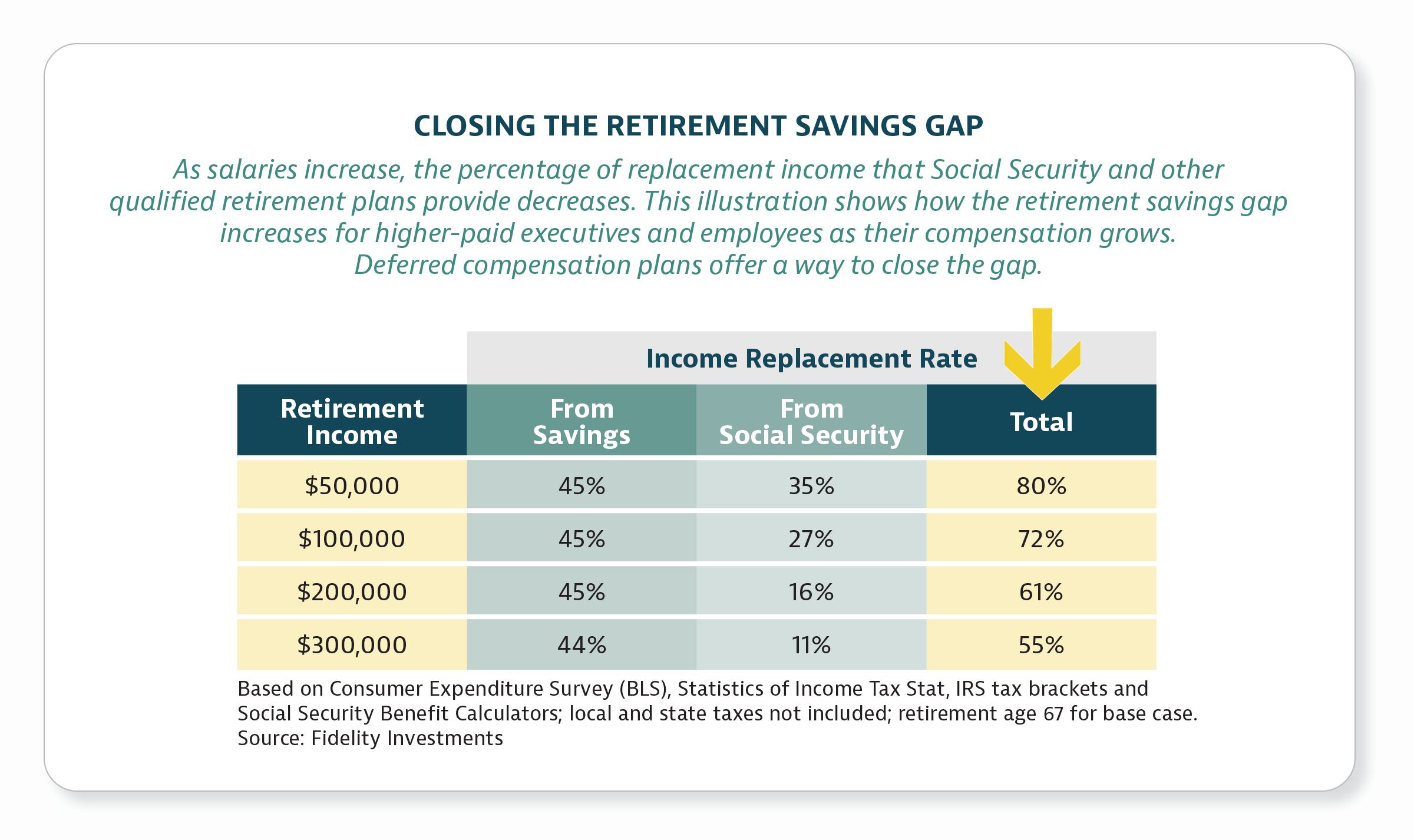

Source: www.homesteadfunds.com

Source: www.homesteadfunds.com

Deferred Compensation Restoring Limited 401(k) Contributions, The maximum amount of annual compensation that can be taken into account under a qualified retirement plan is increased from $330,000 to $345,000. Contributions can be changed at any time (suggested.

Source: earlyretirement.netlify.app

Source: earlyretirement.netlify.app

Retirement plan 2022 Early Retirement, The excess deferrals will be treated as taxable income to the participant in the year they were. The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $23,000 in 2024.

Source: www.dochub.com

Source: www.dochub.com

Deferred compensation agreement template Fill out & sign online DocHub, 2024 tax brackets and standard deduction. For 2024, this limitation is increased to $53,000, up from $50,000.

Source: safelandingfinancial.com

Source: safelandingfinancial.com

Financial Planning for Dell Employees, 2024 change2023 maximum salary deferral (single taxpayers and married couples filing jointly) $5,000 $5,000 no change (not indexed) maximum salary deferral (married. 2023 2024 401k/403b/457/tsp elective deferral limit.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, The 401k/403b/457/tsp contribution limit is $22,500 in 2023. Employees age 50 or older may contribute up to an.

Source: xobin.com

Source: xobin.com

What is Deferred Compensation? Meaning, Types and Benefits, Contributions can be changed at any time (suggested. December 11, 2023 | kathryn mayer.

Increase In Contribution Limits For 457(B) Plans:

Download a printable pdf highlights version of.

Employees Age 50 Or Older May Contribute Up To An.

Irs releases the qualified retirement plan limitations for 2024: